Keerthana Gold Loans Branches:

Keerthana Gold Loans branches offer a reliable solution for individuals seeking financial assistance backed by their gold assets. These branches provide a straightforward, hassle-free process for obtaining loans, ensuring customers can access funds quickly and efficiently. With a strong presence in various locations, they cater to the diverse needs of borrowers, making gold loans accessible to a wider audience.

The services provided by Keerthana Gold Loans extend beyond just lending; they include personalized customer support to guide clients through the process. Each branch is equipped with knowledgeable staff who can answer queries and help customers make informed decisions regarding their loans. This commitment to service excellence sets them apart in the financial landscape.

Navigating financial challenges can be daunting, but Keerthana Gold Loans branches stand ready to assist. By offering competitive interest rates and flexible terms, they empower individuals to leverage their gold for financial stability.

Overview of Keerthana Gold Loans

Keerthana Gold Loans offers a range of services tailored to meet the financial needs of customers while maintaining a strong branch presence. It is crucial for potential borrowers to understand their offerings and how extensive their network is.

Services and Products

Keerthana Gold Loans primarily provides gold-backed loans, allowing customers to leverage their gold assets for quick financial support. The loan process is typically straightforward, involving an evaluation of the gold’s purity and weight.

Key features include:

- Loan Amounts: Customers can receive loans that generally range from 75% to 90% of the gold’s market value.

- Tenure Options: Flexible repayment tenures cater to various financial situations.

- Interest Rates: Competitive interest rates, often lower than those offered by traditional banks, make these loans attractive.

Additionally, they may offer services such as gold insurance and loan renewal options, ensuring customers have comprehensive support throughout the borrowing process.

Branch Network

Keerthana Gold Loans operates numerous branches across different regions, enhancing accessibility for customers. Each branch is equipped with trained staff ready to assist borrowers at every stage.

- Geographical Coverage: The branches are strategically located in both urban and rural areas to cater to diverse demographics.

- Customer Support: Knowledgeable loan consultants at each location provide personalized advice and guidance.

This extensive branch network not only facilitates easier loan processing but also builds trust within the community, making Keerthana a preferred choice for gold loans.

Loan Application Processes

Applying for a gold loan at Keerthana Gold Loans involves several steps that ensure a smooth experience. This section focuses on the methods to apply and the specific loan schemes available, along with eligibility criteria.

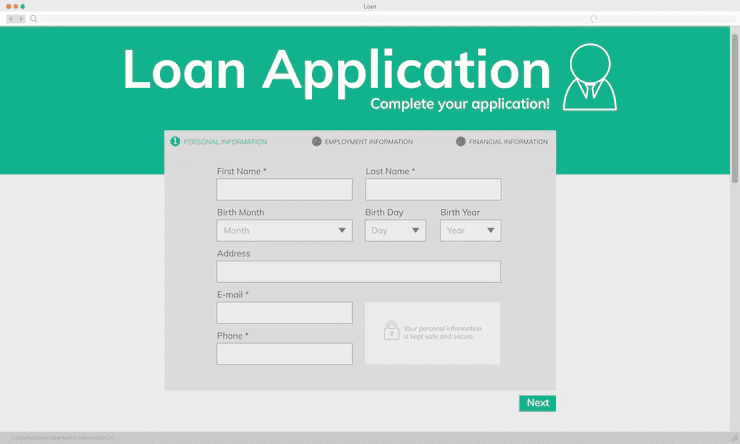

Online Applications

Keerthana Gold Loans allows customers to apply for loans online, making the process convenient. Applicants can visit the official website and fill out the application form.

- Personal Details: Customers need to provide personal information such as name, address, and contact details.

- Loan Amount: The desired loan amount against the gold must be specified.

- Gold Assessment: An option to upload images of the gold is available for preliminary valuation.

Once submitted, the application undergoes verification. After successful verification, the applicant receives approval followed by details on the loan agreement.

Loan Schemes and Eligibility

Keerthana Gold Loans offers various loan schemes tailored to different needs. Eligibility often depends on the scheme selected.

- Personal Loan with Bad Credit: This option is available for those with low credit scores. Applicants might face higher interest rates.

- Annasaheb Patil Loan: Aimed at farmers, this scheme supports agricultural financing.

- DIC Loan Scheme: Designed for small-scale industries, providing necessary financial support.

- SBI PM Swanidhi Loan Online Eazytonet: Focused on street vendors, this scheme supports business development.

- Farmer Loan Redemption Scheme: Specific to farmers in Uttar Pradesh, it aids in loan repayments.

Each scheme has its specific eligibility criteria, usually requiring proof of income, age, and ownership of the gold.

Credit and Investment Options

Exploring credit and investment options is vital for financial planning. This section addresses specific avenues available for individuals looking to enhance their financial status.

Saving Certificates and Credit Scores

The Mahila Samman Savings Certificate is tailored for women seeking secure savings. It offers a competitive interest rate, making it an attractive option for long-term savings.

A good credit score is generally considered to be 700 or above. Individuals can improve their scores by making timely payments, maintaining low credit utilization, and checking their scores regularly. Understanding how fast someone can raise their credit score often begins with addressing any inaccuracies in their credit report.

Credit Card and Loan Advantages

Credit cards are effective tools for building credit history. Options like SBI Home Loan sometimes provide access to a free CIBIL score, helping individuals stay informed about their credit status.

Personal loans for students with no job may be limited, but some lenders offer options based on future earning potential. Utilizing credit cards wisely can lead to benefits like reward points and cashback, further enhancing financial flexibility.

Investing in Gold

Gold has long been considered a reliable investment. It often acts as a hedge against inflation, maintaining value over time.

Investing in gold can take various forms, including physical gold, gold ETFs, or sovereign gold bonds. Each option has its own set of benefits and risks. Given its historical stability, many view gold as a prudent investment choice.

Special Loan Categories

Keerthana Gold Loans offers various special loan categories tailored to meet specific financial needs. These categories include loans for agriculture, minority groups, and individuals with disabilities, ensuring broader financial access.

Agricultural and Livestock Loans

These loans are designed to support farmers engaged in agricultural practices and livestock management. The Bakri Palan Loan is specifically aimed at those raising goats and sheep, providing funds for purchasing and maintaining these animals.

Furthermore, loans under the Pradhan Mantri Awas Yojana – Urban (PMAY-U) can assist farmers in obtaining housing finance. Benefits include lower interest rates and flexible repayment options, tailored to the agricultural cycle.

In addition, borrowers may find Gramin Bank Personal Loan options favorable due to competitive interest rates, allowing agricultural professionals to invest in equipment or technology that increases productivity.

Minority and Societal Loans

Keerthana Gold Loans recognizes the unique financial barriers faced by minority communities. TS Minority Loans are available to eligible applicants, providing financial support for education, business, and housing. These loans often feature lenient eligibility criteria, making them accessible.

Loans for societal development promote entrepreneurship and self-employment among minorities. Society Loans support community projects aimed at upliftment, fostering collective business initiatives. Interest rates for these loans are usually subsidized, ensuring affordability for all members of the society.

Disability and Employment Loans

For individuals with disabilities, Handicapped Loans provide vital funds for independent living and self-sustenance. These loans enable borrowers to finance assistive devices or education that enhances employability.

Options like the Salary Advance Loan Without CIBIL Check cater to those who may struggle with traditional credit assessments. This feature ensures that individuals with disabilities retain access to necessary funds without a burdensome application process.

Employment loans are also available, aimed at individuals seeking to establish a sustainable income. These loans focus on vocational training and skill development, essential for gaining employment.

Interest Rates and Financial Education

Interest rates on loans greatly influence borrowing costs. Understanding financial education empowers borrowers to make informed decisions regarding loans.

Bank Interest Rates

Interest rates for loans from banks can vary widely. For example, Agi Home Loan Interest Rate typically ranges from 7% to 9%, depending on the borrower’s credit profile. JK Bank Housing Loan Interest Rate often falls within a similar range.

Cooperative banks also offer competitive rates. Cooperative Bank Loan Interest Rates can start as low as 6.5%, making them an attractive option for many borrowers. Personal loans from cooperative banks generally feature higher rates, around 10% to 13%. It is crucial for borrowers to compare these rates, as even a small difference can impact overall repayment amounts.

Borrowers should also consider any applicable fees, as they can add to the effective interest rate of a loan.

Understanding Financial Terms

Financial education includes grasping key loan-related terms. Borrowers should understand what APR (Annual Percentage Rate) means, as it reflects the true cost of borrowing. It encompasses both the nominal interest rate and any associated fees.

Another important term is EMI (Equated Monthly Installment), which indicates the fixed amount paid each month. Calculating EMIs helps borrowers plan their budgets effectively.

To assist with calculations, tools like online EMI calculators can be useful. Additionally, knowing how to calculate retained earnings can aid in assessing personal financial health. This knowledge equips individuals with the skills to evaluate different loan options and choose what aligns with their financial goals.

Loan Approval and Disbursement

The loan approval process for Keerthana Gold Loans involves several key steps for securing both home and education loans. Each type has specific requirements that borrowers must meet to facilitate a smooth disbursement.

Securing a Home Loan

Securing a home loan with Keerthana Gold Loans can be optimized by understanding the requirements. Applicants need to provide proof of income, property documents, and their CIBIL score.

Key considerations include:

- Home Loan for Low CIBIL Score: Options are available for those with a low score, but interest rates may vary.

- Documents Required: A sanction letter from JM Financial or similar institutions can expedite the process.

Once the documents are submitted, the verification process begins. Approval times can range from a few days to weeks, depending on the accuracy of the information provided. Upon approval, funds are disbursed quickly, enabling timely purchases.

Education and Car Loans

For education loans, Keerthana Gold Loans caters to various educational needs, assisting students with financing their studies. NBFC education loans often require an education loan sanction letter, which serves as proof of funding.

Important points include:

- HDFC Credila Education Loan Login can help borrowers track their application status online.

- Interest Rates: Competitive rates offered may vary depending on the institution and borrower profile.

Car loans follow a similar approval process, requiring documents related to income and the vehicle being purchased. Once approved, funds are disbursed directly to the dealership or the borrower. With institutions like Motilal Oswal facilitating these loans, borrowers have multiple options to choose from.

Loan Repayment and Alternatives

Understanding loan repayment options is crucial for borrowers utilizing gold loans. Various alternatives in the lending space can provide faster, more flexible solutions based on individual needs.

Short-Term and Payday Loans

Short-term loans, including payday loans, offer quick access to cash for those in need. Institutions like Apex Loan and Oroboro Loans target borrowers who require immediate financial relief before their next paycheck.

Payday loans typically need to be repaid within a short period, usually ranging from a few weeks to a month. Borrowers in Bangalore and Mumbai can find options tailored to local demand, like Instant Payday Loans. Interest rates are often higher than traditional loans, so it’s important to assess total repayment costs.

Key Features:

- Amount: Usually limited to a small sum based on income.

- Repayment Period: A few weeks to a month.

- Application Process: Typically straightforward and fast, often allowing for online applications.

Loan Apps and Rapid Loans

Loan apps like Northern Arc Capital and Daily Loan App have made securing funds even more convenient. These platforms cater to borrowers seeking rapid loans, often with minimal documentation required.

Rapid loans generally provide approval within hours, allowing borrowers to address urgent expenses promptly. Users should compare interest rates and terms across different apps to find the best fit for their financial situation.

Considerations for Loan Apps:

- Speed: Quick funding is a major advantage.

- Fees: Look out for application and processing fees.

- Accessibility: Many apps have user-friendly interfaces that enhance customer experience.