For anyone looking to maximize their spending, choosing the right cash back card can make a significant difference. The best cash back cards offer rewards on everyday purchases, helping users earn money back effortlessly. With a variety of options available, understanding the unique benefits of each card can lead to smarter financial choices.

Many cash back cards provide robust rewards for specific categories, such as groceries, gas, or dining. This feature allows users to tailor their card choices to their spending habits, ensuring that they receive optimal benefits. By selecting a card that aligns with their lifestyle, individuals can achieve greater savings over time.

Navigating the landscape of cash back cards requires careful consideration, but the potential for financial rewards is worth the effort. Whether seeking a straightforward flat-rate card or one with rotating bonus categories, there is likely an option that fits anyone’s needs. Exploring the top choices can lead to discovering the card that resonates best with one’s financial goals.

Understanding Cash Back Credit Cards

Cash back credit cards offer consumers a way to earn rewards through their everyday purchases. These cards can vary in terms of cash back rates and categories, making it essential to understand their features before choosing a card.

What Are Cash Back Credit Cards?

Cash back credit cards are financial products that reward users with a percentage of their spending as cash back. This reward is often expressed as a percentage of the purchase amount. For example, a card might offer 1.5% cash back on all purchases or up to 5% in specific categories, such as groceries or gas.

Different banks provide various cash back cards, each with its unique terms. Major banks like Chase, Discover, and Citi have popular options tailored to different spending habits. Some cards require an annual fee, while others do not, impacting their overall value.

How Cash Back Cards Work

When a consumer uses a cash back card for purchases, they accumulate points or percentages based on their spending. For instance, if someone spends $1,000 on a card offering 2% cash back, they would earn $20.

Cash back can be redeemed in several ways, including statement credits, bank deposits, or gift cards. Users should check the redemption options before applying, as these vary by issuer. Additionally, some cards feature rotating categories, which might require users to enroll each quarter to maximize cash back rates.

Pros and Cons of Cash Back Cards

Cash back credit cards offer benefits such as rewards on everyday spending and straightforward redemption processes. They often have no complicated points systems, making it easy for users to understand their rewards.

However, there are drawbacks. Some cards may come with higher interest rates or annual fees. Additionally, managing spending to earn maximum cash back can be challenging, leading to potential overspending. It is crucial to compare options when selecting a cash back card to ensure it aligns with financial habits and goals.

Evaluating Card Features

When selecting the best cash back cards, evaluating key features is crucial. Focus on the reward structures, interest rates, introductory offers, and redemption options.

Reward Structures

Reward structures determine how cardholders earn cash back on their purchases. Common structures include flat-rate rewards, tiered rewards, or rotating categories.

- Flat-Rate Rewards: Offer the same cash back percentage on all purchases. For instance, a card with 1.5% cash back is straightforward and appeals to users who prefer simplicity.

- Tiered Rewards: Provide higher percentages on specific categories such as dining or gas. For example, a card may offer 3% cash back for dining and 2% for groceries, making it suitable for those with regular spending in these areas.

- Rotating Categories: Change every quarter, offering higher returns in different areas. Cardholders must opt into these categories, which can be advantageous for savvy spenders.

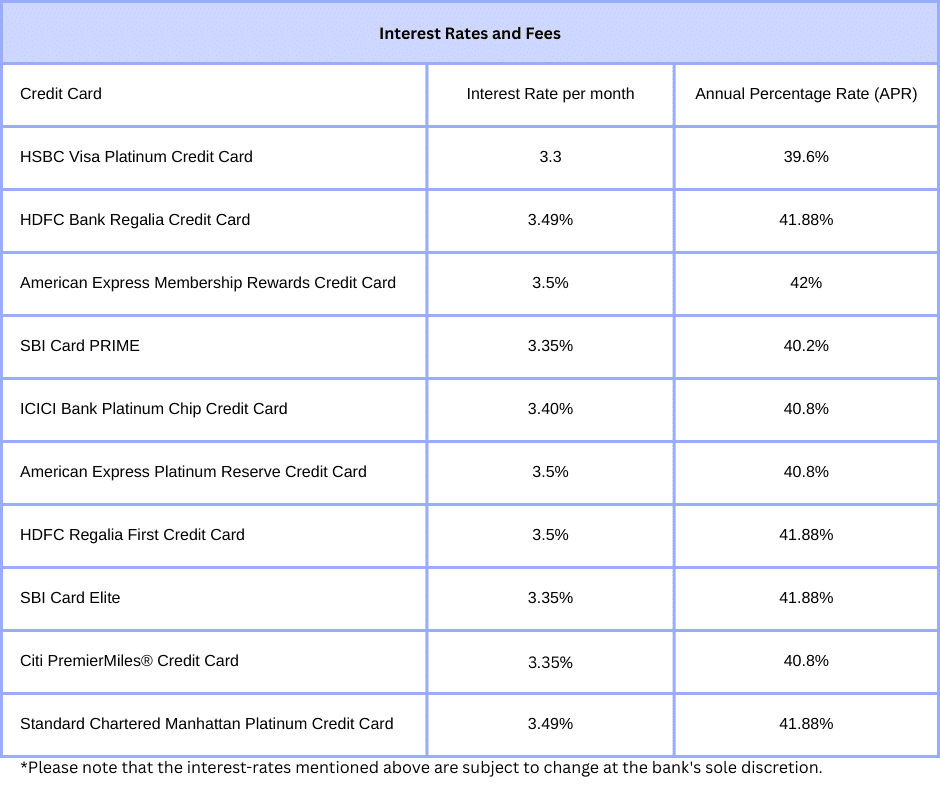

Interest Rates and Fees

Understanding interest rates and fees is essential when evaluating cash back cards. High-interest rates can negate the benefits of rewards for balances carried monthly.

- APR: Look for competitive annual percentage rates (APRs). Low rates benefit those who may carry a balance.

- Annual Fees: Many cash back products have no annual fees. However, some premium cards may charge fees but offer better rewards or additional perks like lounge access.

- Foreign Transaction Fees: Important for travelers, a card without foreign transaction fees can save money while using the card abroad.

Introductory Offers and Sign-up Bonuses

Introductory offers attract new customers and can significantly enhance the card’s value. These bonuses reward cardholders for meeting certain spending requirements within the first few months.

- Sign-up Bonuses: Cards may offer cash back bonuses, such as $200 after spending $1,000 in the first three months. This can provide excellent immediate value.

- Introductory APR Offers: Some cards feature 0% APR on purchases or balance transfers for the first year. This is beneficial for those needing to make large purchases.

Considering these offers alongside long-term benefits is crucial for maximizing cash back rewards.

Redemption Options and Flexibility

Redemption options vary by issuer and can affect how users utilize their rewards.

- Cash Back: The most straightforward method, allowing users to redeem rewards as statement credits or direct deposits.

- Gift Cards or Merchandise: Some cards allow cash back to be redeemed for gift cards or specific products, which might offer extra value.

- Point Systems: Some cards convert cash back to points, which can be redeemed for travel or experiences, adding flexibility.

When assessing a card’s value, it’s important to ensure that the redemption methods align with the cardholder’s preferences and spending habits.

Top Cash Back Cards Overview

Cash back cards are a popular choice for those looking to earn rewards on everyday purchases. Features vary widely, from high percentage rewards to specific category bonuses. Understanding these distinctions helps users select the card that best meets their financial needs.

Best Overall Cash Back Cards

The ICICI Sapphiro Credit Card is often highlighted as a top pick. It offers a comprehensive cash back program featuring 2% on international spends and up to 5% on select categories. Additionally, it provides benefits like airport lounge access and travel insurance, adding extra value for frequent travelers.

The American Express Cash Magnet Card also earns recognition for its flat cash back rate of 1.5% on all purchases. This straightforward approach appeals to those who prefer simplicity without dealing with rotating categories or limits.

Best for High Percentage Rewards

For those seeking maximum cash back on specific purchases, the HSBC Payment Credit Card shines with an impressive 5% cash back on online shopping and dining. This card is suited for consumers who prioritize food and entertainment spending.

The Best Gas Credit Card often features rewards that cater to drivers, frequently offering 3% to 5% back on fuel purchases. Cards like the Costco Anywhere Visa® Card also provide 4% cash back on eligible gas purchases, making them ideal for frequent road travelers.

Best for No Annual Fee

For cardholders looking to avoid fees, the Highest Cash Back Credit Card with No Annual Fee options, such as the Discover it® Cash Back, stand out. This card provides 5% cash back on rotating categories, which can include restaurants, grocery stores, and more, making it versatile for various spending habits.

Another competitive choice is the Chase Freedom Flex, which offers 5% cash back on specific categories, along with a straightforward 1% on all other purchases. Users can maximize rewards without worrying about annual fees, appealing to budget-conscious consumers.

Best for Specific Categories

Certain cash back cards excel in niche areas. The Best International Travel Credit Card, like the Capital One VentureOne Rewards Credit Card, rewards users with 1.25 miles per dollar on every purchase, transferable to various travel partners. Ideal for international travelers, its lack of foreign transaction fees makes it a strong choice.

Additionally, cards like the Citi Double Cash Card provide 2% cash back—1% at purchase and 1% when the bill is paid. This dual structure benefits those who prioritize paying off their balances regularly and want to maximize their cash back earnings.

Maximizing Cash Back Rewards

Maximizing cash back rewards involves strategic planning and smart usage of credit cards. By understanding different earning strategies and knowing how to leverage card benefits, one can significantly increase their cash back benefits.

Strategies for Earning More Cash Back

To maximize cash back, it’s crucial to select the right cards based on spending habits. For instance, cashback credit cards often offer higher percentages for specific categories like groceries or gas. By using a card that offers 5% back on gas purchases, individuals can earn more on regular expenses.

Another effective strategy includes taking advantage of promotional offers and bonuses. Many banks provide increased cash back during special promotions or for certain spending thresholds. Keeping track of these offers can lead to higher rewards.

Combining Cards for Maximum Benefits

Using multiple cards can enhance cash back returns. For example, a user might utilize a best credit card for online purchases that yields 3% cash back on all online spending while pairing it with another card that provides 2% on dining.

This strategy requires knowing the strengths of each card and combining them effectively. Furthermore, some cards offer additional bonuses when spending in certain categories. Strategic pairing can lead to a cumulative effect, maximizing potential cash back earnings.

Understanding Bonus Categories

Many cash back cards feature rotating bonus categories that can change quarterly. Identifying these categories is key to maximizing rewards. For example, a card may offer 5% cash back on home improvement stores in one quarter and then shift to restaurants in the next.

To benefit, one must stay updated on these changes and plan purchases accordingly. Using a calendar or reminder system can help consumers optimize their spendings in line with the bonus categories.

Avoiding Common Pitfalls

While pursuing cash back rewards, it’s crucial to avoid common mistakes. One major pitfall is overspending to earn rewards, which can lead to debt. It’s essential to maintain a budget and only spend within means.

Additionally, not paying off the balance in full can negate rewards due to interest charges. Lastly, failing to track expiration dates for rewards points or cash back bonuses can result in lost benefits. Staying organized and informed is vital for maximizing cash back rewards effectively.

Credit Cards and Financial Planning

Credit cards can play a significant role in effective financial planning. Their judicious use can support credit building and enhance reward earning potential, but they also pose risks related to debt management.

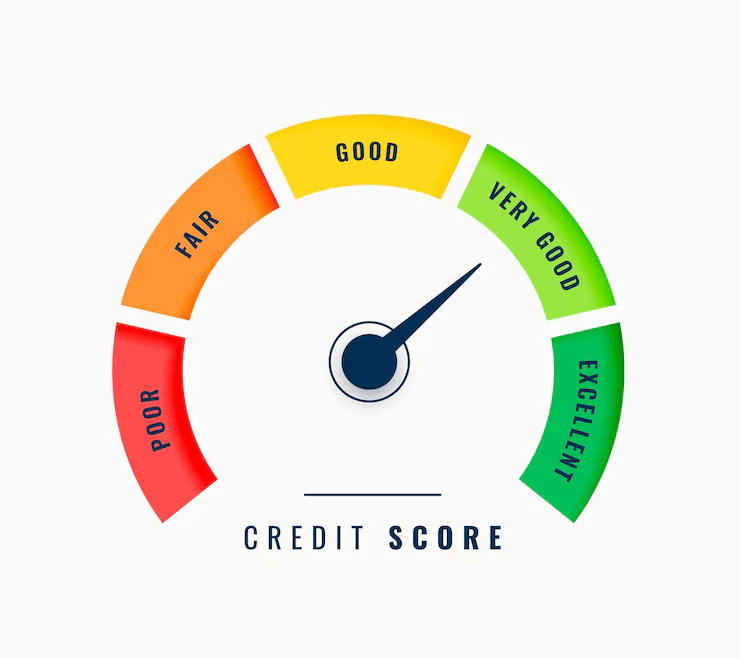

Impact on Credit Score

Using credit cards responsibly can positively influence a person’s credit score. Payment history, credit utilization, and length of credit history are critical factors.

- Payment History: Making timely payments boosts the credit score significantly.

- Credit Utilization: Keeping the balance under 30% of the total credit limit is advisable.

- Diversity of Credit: Having a mix of credit accounts, including credit cards, can enhance the CIBIL score, which is important for securing personal loans and favorable interest rates.

Understanding how credit cards affect credit metrics is essential for maximizing one’s financial health.

Balancing Rewards with Financial Goals

Maximizing cash back on credit cards requires a balance with long-term financial objectives. Reward programs can be beneficial if aligned with spending habits.

- Know Your Spending: Identifying regular expenses helps choose a card that maximizes rewards.

- Avoid Unnecessary Purchases: Using a credit card should not lead to overspending. Only charge what can be repaid in full each month.

- Cash Back Categories: Some cards offer higher rewards in specific categories like groceries or gas. Knowing which categories to prioritize aids effective budgeting.

This proactive approach aligns reward accumulation with broader financial goals.

Credit Card Debt Management

Managing credit card debt is crucial for financial stability. High-interest rates can lead to significant financial strain if left unchecked.

- Set a Repayment Plan: Prioritizing payments on higher-interest cards helps reduce overall debt faster.

- Utilize Balance Transfers: Some cards offer promotional balance transfer rates to manage existing debt effectively.

- Monitor Spending: Tracking expenses and setting budgets can prevent debt accumulation.

Effective debt management is essential for maintaining a healthy financial profile while benefiting from cash back rewards.

Additional Financial Products for Comparison

Exploring additional financial products can enhance one’s understanding of potential savings, loans, and investments. Various options offer specific advantages, tailoring choices to individual financial goals.

Saving Accounts and FDs

Savings accounts provide easy access to funds while earning minimal interest. Interest rates usually range from 2% to 4% annually, depending on the bank.

Fixed Deposits (FDs) offer better returns with interest rates often between 5% and 7%. Senior citizen FD rates generally offer additional benefits, sometimes up to 0.5% higher.

For instance, Bank of India provides competitive FD rates, while Post Office FDs can reach up to 7.5%. The SBI Sukanya Samriddhi Yojana stands out, offering around 7.6%, making it an excellent choice for planning children’s education.

Loan Options and Interest Rates

Loan options vary widely, impacting overall financial planning. Canara Bank offers home loan interest rates starting at 6.65%, making home purchases more accessible.

For personal financing, interest rates can range from 10% to 15%, while gold loans at Canara Bank might start around 9.5%. These options present various financial pathways depending on the individual’s needs.

It’s also worth considering government schemes like the National Savings Certificates from the Post Office, offering a fixed return, beneficial for risk-averse investors.

Investment Vehicles and Returns

Investment vehicles can significantly influence long-term wealth in different ways. The Public Provident Fund (PPF), with its current interest rate of 7.1%, is favorable for those seeking secure growth.

Stocks, mutual funds, and fixed-income securities provide diverse risks and returns. The Sukanya Samriddhi Scheme offers attractive rates while encouraging savings for education.

Additionally, National Savings Certificates provide assured returns, appealing to conservative investors. Comparing these options helps individuals choose the best fit based on risk tolerance and financial goals.

Additional Financial Instruments and Services

Numerous financial services enhance the utility of cash back cards, providing convenience and accessibility. Online banking and customer support play crucial roles in a cardholder’s experience.

Online and Mobile Banking Services

Online and mobile banking platforms simplify managing cash back cards. Users can check balances, view transaction history, and make payments anytime, which adds convenience.

Financial institutions like SBI offer services such as NEFT transactions, which enable quick fund transfers. Timing for these transactions may vary, but typically, they are processed promptly during SBI bank timings.

Users can also access specific features like applying for SBI E Mudra loans online, ensuring funds are available for various needs. Other mobile services include activating an SBI ATM card and checking Union Bank balance via a dedicated number.

Customer Care and Support

Effective customer care is essential for resolving issues related to cash back cards. Institutions typically provide multiple channels for support, including phone, chat, and email.

For SBI cardholders, the Yono SBI customer care number is readily available for immediate assistance. Questions regarding services like employer contributions to PF or how to withdraw PF amount online can be answered quickly.

Proper guidance is also given for updates, like how to update a mobile number in Aadhar or how to activate a UAN. Quick access to customer care improves user satisfaction and enhances the overall banking experience.