Payday Loan in Mumbai:

In Mumbai, payday loans have become a popular solution for individuals seeking quick access to cash. These loans provide a fast way for borrowers to meet urgent financial needs without lengthy approval processes. This option may seem appealing, especially for those facing unforeseen expenses or cash flow issues.

However, potential borrowers should be aware of the risks involved. Understanding the terms, interest rates, and repayment schedules is crucial for making an informed decision. The accessibility of payday loans in Mumbai often leads to a cycle of debt if not managed properly.

For those considering a payday loan, it is essential to evaluate alternatives and ensure that this option aligns with their financial situation. Armed with the right information, borrowers can navigate the lending landscape effectively.

Understanding Payday Loans

Payday loans offer quick financial assistance but come with specific risks. They are designed to provide immediate cash for borrowers facing short-term financial challenges, often with higher interest rates and fees.

What Is a Payday Loan?

A payday loan is a short-term borrowing option, typically due on the borrower’s next payday. In Mumbai, these loans cater to individuals who may need cash urgently, such as for medical expenses, bill payments, or other unexpected costs.

Key features of payday loans include:

- Loan Amount: Generally ranges from ₹1,000 to ₹30,000.

- Interest Rates: Often high, with APRs reaching over 100%.

- Repayment: Due within a few weeks, often aligned with the borrower’s pay cycle.

Instant payday loans are widely available, often requiring minimal documentation. This can include a salary slip and proof of identity, making them accessible for many.

Pros and Cons of Payday Loans

Pros of payday loans in Mumbai:

- Quick Access to Cash: Funds can be disbursed within hours.

- No CIBIL Check: Many lenders offer salary advance loans without checking CIBIL scores, making it easier for those with bad credit to qualify.

- Flexibility: Can be used for any purpose, allowing borrowers to address pressing financial needs.

Cons include:

- High Costs: Interest rates are significantly higher than traditional personal loans.

- Debt Cycle Risk: Borrowers may find themselves taking multiple loans to cover previous debts, leading to a cycle of borrowing.

- Regulatory Concerns: Lack of regulation in some areas may lead to predatory lending practices.

Understanding these aspects allows potential borrowers to make informed decisions regarding using payday loans.

Payday Loan Regulations in Mumbai

Payday loans in Mumbai are subject to specific regulations that aim to protect consumers and ensure fair lending practices. This section discusses the legal framework governing payday loans and the associated interest rates and fees.

Legal Framework and Compliance

In Mumbai, payday loans fall under the purview of the Reserve Bank of India (RBI) and the Microfinance Institutions (Development and Regulation) Act, 2006. Lenders must register with the RBI to operate legally. Compliance with the guidelines set forth by the RBI is mandatory, ensuring that operations remain transparent and equitable.

Lenders are required to disclose the terms of the loan, including repayment schedules and fees. They must adhere to the Fair Practices Code, which prohibits harassment during loan recovery. Non-compliance can lead to strict penalties or revocation of licenses, reinforcing the importance of adhering to these regulations.

Interest Rates and Fees of Payday Loan

Payday loans typically carry high interest rates, which can vary widely among lenders. Cooperative banks often offer slightly lower rates compared to non-banking financial companies (NBFCs). As of now, interest rates can range from 12% to 36% per annum, depending on the lender and the borrower’s credit profile.

Other fees may include processing fees, late fees, and prepayment penalties. It’s critical for borrowers to read the fine print before signing any contracts. Transparency about these charges can help borrowers avoid unexpected costs and make informed decisions about managing their loans effectively.

Loan Options and Alternatives

For individuals seeking financial assistance, various loan options and alternatives are available beyond payday loans. These options cater to different needs and financial situations.

Short-Term Personal Loans

Short-term personal loans are suitable for those in urgent need of cash. These loans can be accessed quickly and often require minimal documentation. Many lenders now offer personal loans for individuals with bad credit, making them accessible to a broader audience.

Key features:

- Loan Amounts: Typically range from ₹10,000 to ₹50,000.

- Repayment Terms: Usually between 3 to 12 months.

- Interest Rates: Vary; it’s crucial to compare lenders for the best rates.

For students with no job, certain institutions provide tailored personal loans with relaxed eligibility criteria. Additionally, specialized loans like Chemmanur Gold Loan offer liquidity against gold assets, appealing to those who have valuable items but lack a stable income.

Credit Cards and Building Credit

Credit cards serve as another financial tool for individuals looking to manage funds while building credit history. They can help boost credit scores when used responsibly.

Benefits of credit cards:

- Rewards Programs: Many cards offer points or cash back on purchases.

- Credit Building: Regular payments can improve credit scores.

- Emergency Funds: Available credit can serve as a safety net during unforeseen expenses.

Those looking to build credit should focus on utilizing cards with lower limits. This approach minimizes overspending risk. Additionally, cards aimed at students can be an excellent way to instill good financial habits early on.

Eligibility and Application Process

Understanding the eligibility criteria and application process is essential for those considering a payday loan in Mumbai. This section provides a clear overview of what is required to qualify and how to navigate the application efficiently.

Assessing Eligibility Criteria

Eligibility for a payday loan typically hinges on several factors. Applicants must be at least 18 years old and should be Indian citizens or residents. A stable income source is crucial, as lenders assess repayment capability.

A good credit score enhances borrowing options. Generally, a score of 650 or higher is considered favorable. Some lenders, like Bharatpe, have specific criteria that may include existing bank relationships or income levels. Meeting these requirements increases the likelihood of loan approval.

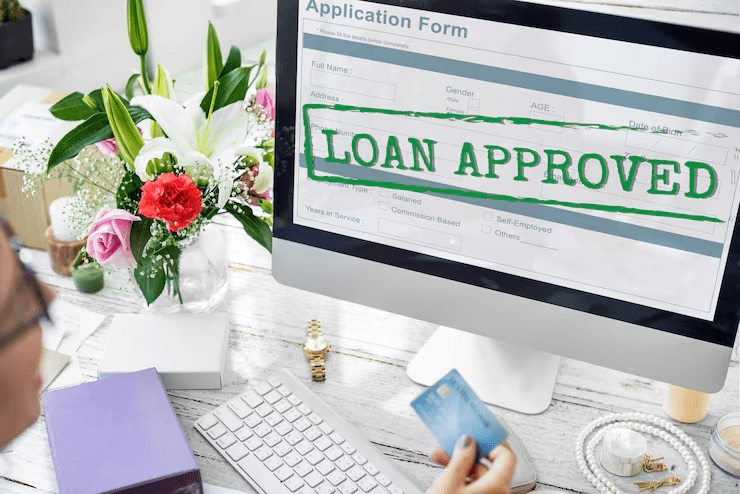

Documentation and Approval

The documentation process for payday loans is straightforward. Applicants usually need to provide proof of identity, such as an Aadhar card or passport, and income verification, through salary slips or bank statements.

Lenders may also require a completed application form detailing personal information. Approval times can vary; some lenders may provide funds within a few hours, while others may take up to 48 hours. Reviewing terms and conditions carefully ensures borrowers make informed decisions before committing.

Financial Strategies and Credit Health

Managing financial health is crucial for securing affordable loans and maintaining a good credit score. This section explores strategies to enhance credit scores and promotes responsible borrowing practices.

Improving Credit Score

A credit score is a numerical representation of an individual’s creditworthiness. A good credit score typically ranges from 700 to 850. Factors affecting credit scores include payment history, credit utilization, and length of credit history.

To calculate retained earnings, track the business’s net income and subtract dividends paid. This helps maintain an accurate financial record, which can influence credit assessments. Regularly checking credit reports for errors is vital. Individuals can raise credit scores by making timely payments, reducing debt, and keeping credit utilization below 30%.

Establishing a diverse credit mix, including revolving and installment accounts, can also boost scores. Monitoring changes every few months can show progress.

Responsible Borrowing Practices

Responsible borrowing practices are essential for maintaining financial stability. Individuals should assess their repayment capacity before taking on loans. A good rule of thumb is to keep debt-to-income ratios under 36%.

Borrowers should avoid taking on multiple payday loans simultaneously, as this can lead to overwhelming debt. It is important to read loan agreements carefully to understand fees and interest rates.

Creating a budget helps manage monthly expenses and savings strategies. Setting aside emergency funds can alleviate stress during repayment periods. Borrowers should aim to pay off loans promptly to avoid high interest and fees, protecting their credit health.

By observing these strategies, individuals can enhance financial well-being while securing favorable loan terms.

Loan Products and Services in Mumbai

Mumbai’s financial landscape offers a variety of loan products tailored to diverse consumer needs. Among these, payday loans are prominent, alongside options from banks and non-banking financial companies (NBFCs), providing flexible solutions for individuals and businesses.

Payday Loan Providers

Payday loans in Mumbai cater to those requiring quick cash solutions. These loans typically feature minimal documentation, allowing quicker access to funds. Providers often include various online platforms and local lenders, offering competitive interest rates.

Some notable providers are Northern Arc Capital and other fintech companies that specialize in short-term loans. They often use digital apps for seamless application processes. Customers can expect loan amounts ranging from ₹5,000 to ₹50,000, usually repaid within a month. It’s crucial for borrowers to assess repayment terms to avoid falling into a debt cycle.

Bank and NBFC Options

Both banks and NBFCs in Mumbai offer multiple loan products. State Bank of India (SBI) provides services like home loans, where applicants can check their free CIBIL scores. This tool assists individuals in understanding their creditworthiness before applying.

NBFCs also play a pivotal role, especially in education financing. They often provide tailored education loans to students, covering tuition fees and other expenses. Various loan products are available, with varying interest rates and repayment options designed to meet specific customer needs. This diversity ensures that Mumbai residents have access to suitable financial products.

Government Schemes and Subsidies

The Indian government offers various schemes and subsidies aimed at improving financial accessibility for citizens. These initiatives cater to diverse needs including housing, savings, and personal loans, thus aiding those who might seek payday loans.

Central and State Initiatives

Several central and state-level initiatives facilitate easier access to finance. One notable scheme is the Pradhan Mantri Awas Yojana – Urban (PMAY(U)), which provides financial assistance for housing. Eligible beneficiaries can receive subsidies on home loans up to INR 2.67 lakh.

Additionally, the Mahila Samman Savings Certificate encourages women to save with attractive interest rates, enhancing their financial independence. State governments may also offer District Industries Centre (DIC) loans, aimed at small businesses and individuals alike. These loans can help users avoid high-interest payday loans by providing a more affordable alternative.

Special Focus Schemes

Focused on rural development, the Gramin Bank home loan scheme offers lower interest rates compared to traditional payday loans. This initiative aims to promote home ownership in rural areas, which can significantly impact economic stability.

For women entrepreneurs, specific programs are in place to provide financial support and training. These schemes often offer preferential interest rates, making them a viable option to traditional loans. By leveraging these government initiatives, individuals can make more informed financial decisions and minimize reliance on high-interest loans.

Investment and Financial Planning

Investment and financial planning are essential for maintaining financial health and achieving long-term goals. This section emphasizes the importance of choosing the right investment avenues and planning for future needs.

Gold as an Investment

Gold has historically been considered a safe-haven asset. Many investors view it as a hedge against inflation and currency fluctuations.

- Market Trends: In India, gold prices often rise during festive seasons, positively influencing investment returns.

- Liquidity: Gold can be easily sold or pledged for loans, providing liquidity and quick access to cash.

Investing in gold can take various forms, including physical gold (jewelry, coins), gold ETFs, or sovereign gold bonds. Each has unique advantages and risks.

Savings and Retirement Planning

Effective savings and retirement planning secure financial stability for the future.

- Emergency Funds: Experts recommend maintaining three to six months of expenses in a liquid form for unforeseen circumstances.

- Retirement Accounts: Contributions to accounts like the Employee Provident Fund (EPF) or Public Provident Fund (PPF) offer tax benefits while growing the investment.

Regular reviews of investment portfolios and adjusting strategies based on market conditions are crucial. Adapting to changes ensures that financial goals remain achievable over time.